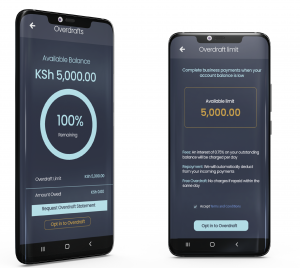

Kopo Kopo Overdraft

Overdraft is a credit facility that allow you to access additional funds to cover your business expenses when your account balance is low.

How Overdraft works

Picture this scenario: You are in the middle of paying suppliers or handling your usual business expenses, and you realize your account balance is insufficient. This is where the overdraft comes into play, ensuring your business keeps moving forward despite expected or unexpected challenges.

Easy repayment

There is no need to worry about managing repayments – we handle it for you. We will automatically deduct from your Lipa Na M-PESA incoming payments towards your balance.

Running overdraft access

Need more funds? Not a problem. Overdraft provides you with a limit that you can tap into repeatedly until you have reached your qualified amount. This offers you peace of mind to focus on growing your business without interruptions.

Our fees are completely transparent, with no hidden surprises. With Kopo Kopo Overdraft, you will pay an interest rate of 0.75% on your outstanding balance, charged per day.

You get immediate access to a digital line of credit, available whenever you need it, right at your fingertips. There are no lengthy forms to fill out, and no waiting period for approval.

Enjoy our Overdraft facility completely free of charge when you settle the amount within the same day.