Power Up Your Business Payments with the New Kopo Kopo Overdraft

Calling all Kenyan business owners! 📢

We have exciting news to share that will help you cover your business expenses with ease.

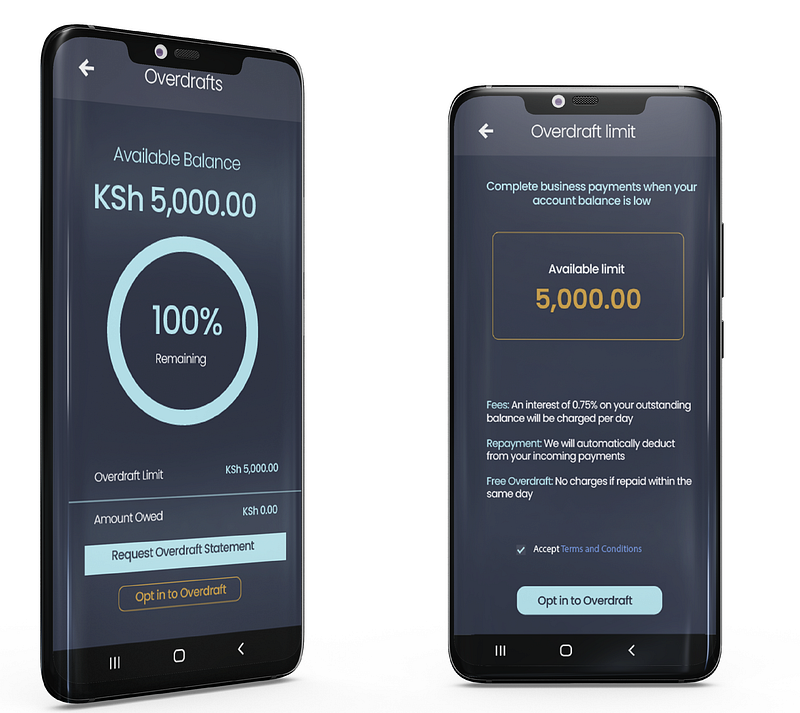

Today, we are rolling out the new Kopo Kopo Overdraft feature — a credit lifeline that will enable you to access additional funds to cover your business expenses when your account balance is low.

What exactly is Kopo Kopo Overdraft about?

Imagine this scenario: You are in the middle of paying suppliers or handling your usual business expenses, and you realize your account balance is insufficient. This is where the overdraft comes into play, ensuring your business keeps moving forward despite expected or unexpected challenges.

What makes Kopo Kopo Overdraft good for your business?

Instant access

You get immediate access to a digital line of credit, available whenever you need it, right at your fingertips. There are no lengthy forms to fill out, and no waiting period for approval. Just a few taps on your phone or computer via our Web App or Android App, and you are ready to go.

Running overdraft access

Need more funds? Not a problem. Overdraft provides you with a limit that you can tap into repeatedly until you have reached your qualified amount. This offers you peace of mind to focus on growing your business without interruptions.

Same-day free overdraft

Enjoy our Overdraft facility completely free of charge when you settle the amount within the same day.

Transparent fees

Our fees are completely transparent, with no hidden surprises. With Kopo Kopo Overdraft, you will pay an interest rate of 0.75% on your outstanding balance, charged per day.

Easy repayment

There is no need to worry about managing repayments — we handle it for you. We will automatically apply your Lipa Na M-PESA incoming payments towards your balance.

Note: You can still use Overdraft as long as there is an available balance.

So, how do you qualify for Overdraft?

It’s simple — just ensure you have an active account with us, and you are good to go.

If you are not already on board, NOW is a good time — please contact us for a Kopo Kopo account and start digitizing your business by accepting Lipa na M-PESA payments and enjoying our suite of business tools.

P.S. Learn more about our simple solution that allows you to make payments directly from your Kopo Kopo account to pay suppliers, staff, or cover business expenses.

Final remarks

Here is to your success with Kopo Kopo — we are here to support you every step of the way as you grow your business.